BACKGROUND

Steve Rider is a 62 years old business owner. His company established a 412i retirement plan 15 years ago, and the plan had assets of $1,500,000. 412i plans are qualified pension retirement plans, designed for large annual contributions, where the plan’s assets must be invested inside whole life insurance and fixed annuities. The reason for the lack of investment choice is because the performance must be guaranteed, per the IRS.

A requirement of 412i plans is that participants must make these large annual contributions each and every year regardless of the company’s performance. After 15 years, Steve’s company was declining and not generating as much revenue as in years past. Due to his company’s uncertain future and the large mandatory contributions, Steve was interested in his options regarding ending the 412i plan.

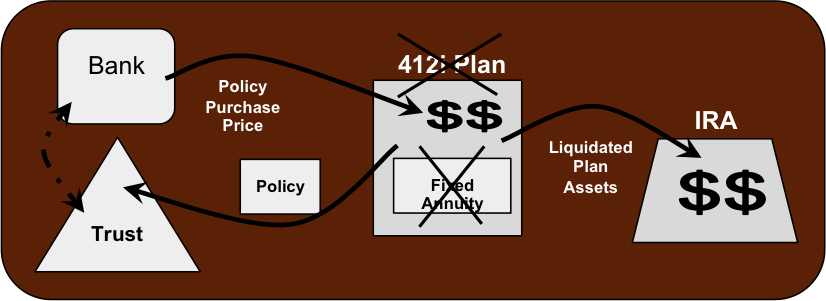

Exiting a 412i plan is complex and requires the third party administrator’s help to make sure all rules and laws are followed. Terminating the plan means both the life insurance policy and annuity are surrendered, and then rolling the cash proceeds into an IRA. At which point, no further contributions are required and the client can invest the assets how they wish.

What started as…

STEVE’S SITUATION

At first look, the reasons to contemplate terminating the 412i plan were straightforward; Steve’s company was winding down and he did not want to commit to the annual cash flow requirement any longer. However, taking a deeper look into Steve’s situation we uncovered additional issues that were large enough for us to recommend Steve had to terminate the plan. These were:

*The life insurance proceeds would be inside Steve’s estate and taxed at 40%.

*Steve had not been recognizing the income each year on the economic benefit, making a large portion of the death benefit income taxable as well.

COMPLICATIONS

Steve’s personal situation created additional challenges:

- Steve was, and is currently, uninsurable. If he surrendered the $2,000,000 life insurance policy his family could not replace it.

- Keeping the life insurance policy meant it had to be transferred out of the 412i plan prior to terminating the plan.

- Therefore, the policy had to be purchased out of the plan for the is its fair market value, about $750,000.

Ended up as…

OUR APPROACH

Steve’s lack of insurability mandated a complex approach here. He successfully beat cancer three years ago, and while he was cancer free he would be uninsurable for a few more years. Therefore, keeping the policy was a must, but Steve had to change the ownership structure immediately as it was creating a very large and unnecessary tax bill.

The solution was Steve needed an insurance trust to purchase the policy from the 412i plan, but to facilitate this the trust would need a loan. The loan would be equal to the policy’s cash value, so the policy itself was sufficient to collateralize the loan entirely. Going forward, Steve will be required to pay the annual interest costs on the loan.

The benefits of this approach far outweighed the costs or added complexity. For example:

- The interest costs were substantially lower than the annual 412i contribution requirements, effectively increasing Steve’s cash flow and lowering his obligations.

- Moving the policy into an ILIT eliminated the unnecessary estate tax on the life insurance proceeds.

- Also, we addressed the potential income tax liability being created from failing to recognize the annual economic benefit of the life insurance.

FINAL THOUGHTS

Steve can pay off the loan at any time by surrendering the policy, but without a replacement policy his family loses a $2,000,000 tax-free asset. In reality the exit strategy for the loan is tied to Steve’s insurability. Once he is insurable again Steve can replace this policy with a cheaper policy. At which point, he will have the option to pay off the loan from the cash value.

Like most of our clients, Steve’s situation required an in depth look and a more thoughtful approach. We will continue to work with Steve to make sure his plan stays on track. In the end, his situation proved challenging and our exit strategy complex, but in this situation a lesser solution really would not have been a solution at all.