- Equity markets around the globe fell into correction territory on intensifying concerns about the coronavirus.

- On average, a correction in the U.S. stock market occurs every year or so and takes about three months to recover.

- Despite the concern that corrections tend to cause, they are necessary for the health of the overall market.

On February 27, 2020, barely two months after returning an impressive 31.49% gain for 2019, the S&P 500 Index fell into correction territory—that is, when a stock-market index declines by 10% or more from its most-recent high. The drop was triggered by a sharp rise in fears about the China-born coronavirus and the impact of its rapid spread on the global economy. It’s understandable that investors may be alarmed by such a dramatic market plunge, but it’s important to recognize three important facts about stock-market corrections:

- They are quite common.

- They aren’t typically tied to an economic crisis.

- They are actually necessary for the health of the overall market.

Corrections are common

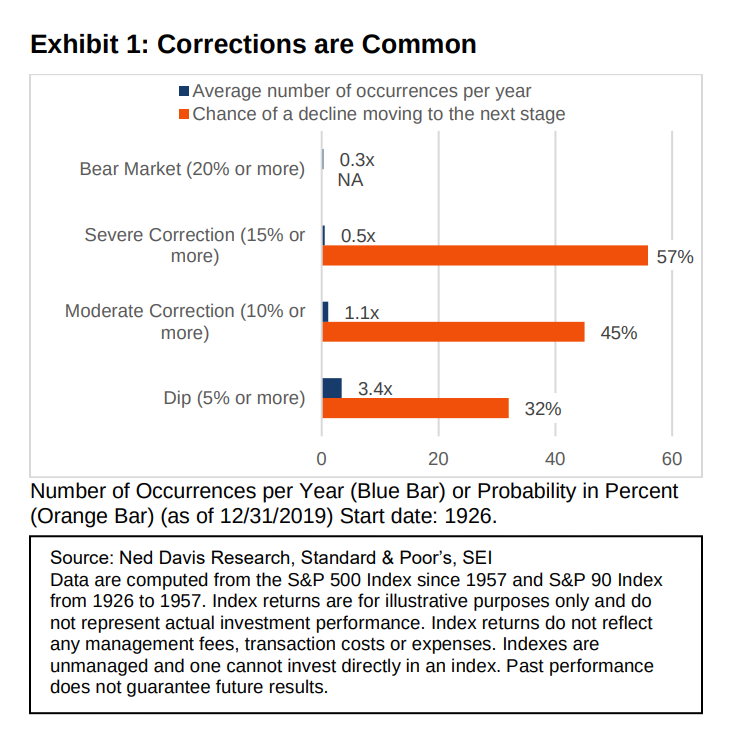

Exhibit 1 provides some perspective: On average, U.S. stock-market corrections occur about once every year.

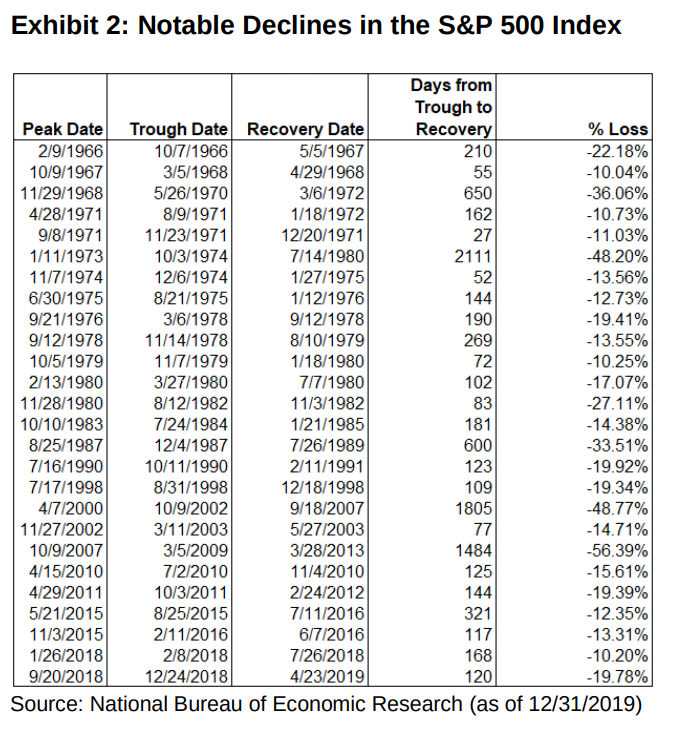

Before this month, the most recent correction in the S&P500 Index took place in September 2018 as intensifyingtrade tensions and rising interest rates took a toll onstock prices. Prior to that, in February of the same year,a surprise jump in average hourly earnings and anincreasingly hawkish Federal Reserve drove the U.S.equity market sharply below recent its high.

Corrections don’t usually equal crisis

A further look back provides additional perspective: As seen in Exhibit 2, the average recovery period for declines of 10% or more is about 12 months. This may sound like a long time, but one year is just a temporary setback for a long-term investment strategy.

Corrections don’t last forever

When markets correct, we think it’s best to just wait. And, as history shows, there’s a solid chance of recovering correction-related losses relatively quickly. No one likes to see the value of their investments decrease, but we know that ups and downs are a normal part of the investment cycle.

Index Definitions:

S&P 500 Index: The S&P 500 Index is an unmanaged, market-capitalization-weighted index that consists of 500 of the

largest publicly-traded U.S. companies and is considered representative of the broad U.S. stock market.

Important Information

This material represents an assessment of the market environment at a specific point in time and is not intended to be a

forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as

research or investment advice and is intended for educational purposes only.

There are risks involved with investing, including possible loss of principal.

Information provided by SEI Investments Management Corporation, a wholly owned subsidiary of SEI Investments

Company.